The changing economy is influencing the way lenders measure their risk when extending credit

Bill Batmann is a small business expert and the CEO of BillionaireU.com, an online business educational site. During a recent interview, Bill Bartmann warned small business owners that they would have to make radical adjustments to their business in order to survive.

“The economy has changed and business has changed,” said Bartmann. Banks, which got into an awful lot of trouble by lending money to people who are unqualified, have now gone to the other extreme. Even those businesses who have already taken steps to reduce overhead must do more in order to become a better risk for banks and to improve their chances for survival.”

Bill Bartmann teaches his students to realize that small business loans are a major part of some lenders’ business. “Banks want to loan money; this is how they make money,” Bartmann explains. “With the changing economy, lenders are forced to tighten their standards and minimize their risk. This means business owners need to make changes in order to demonstrate their ability to repay a business loan.”

Bill Bartmann has been interviewed on television and radio shows and featured in magazines. He has been credited with singlehandedly changing and reforming the collection industry in America. His mission, just as ambitious, is to "reverse the business failure rate in America".

Saturday, November 28, 2009

Sunday, November 8, 2009

Bill Bartmann Discusses Tough Times for Small Business Owners who need Capital

Bill Bartmann has been interviewed on radio and TV and he has been published in many magazines. Here is a story by Joseph A. Mann Jr, that was printed in the Miami Harold.

Lack of Credit Hurts Small Businesses:

For the last quarter of 2008, banks approved 181 working capital loans worth $53.7 million dollars. In the same quarter of 2007, there were 908 loan approvals for a total of $136.5 million.

"The trick is, we can't do anything if the bank doesn't give a loan," said Althea Harris, the SBA's public affairs officer in Miami. Under one of its programs, the SBA provides guarantees for 50 percent to 85 percent of working capital loans for domestic projects, and up to 95 percent for projects involving exports.

A company must first obtain approval from a bank, then apply to the SBA for a guarantee.

When asked about loans to small business, several banks contacted by The Miami Herald said they were still approving small business credits and considered these companies an important element of their business portfolios.

However, some said standards are being tightened. Some also asserted they have increased loans to small business on a nationwide basis. All said they are reaching out to small business clients in an effort to work out financing problems.

"Small business loans are part of our core business and we continue to make these loans," said Nancy Norris, a spokeswoman for JP Morgan Chase and Washington Mutual.

"We have tightened our underwriting standards. We're making an effort to ensure that we provide loans to people who can afford them and that they represent a reasonable risk to the bank. We're working hard with our clients to find solutions."

Other banks contacted were Bank of America, SunTrust, Wachovia (now part of Wells Fargo), and Regions Bank.

Bill Bartmann, a small business expert, warned that if owners of small companies want to survive, they must make radical adjustments to their businesses.

"The economy has changed and business has changed," said Bartmann, chief executive of BillionaireU.com, an online business educational site.

Banks, which "got into an awful lot of trouble by lending money to people who were unqualified," have now gone to the other extreme, he said.

Bartmann, who started up a multi-billion-dollar financial services company with a $13,000 loan, said that even businesses that have already taken steps to reduce overhead must do more in order to become a better risk for banks and improve their chances for survival.

Lack of Credit Hurts Small Businesses:

For the last quarter of 2008, banks approved 181 working capital loans worth $53.7 million dollars. In the same quarter of 2007, there were 908 loan approvals for a total of $136.5 million.

"The trick is, we can't do anything if the bank doesn't give a loan," said Althea Harris, the SBA's public affairs officer in Miami. Under one of its programs, the SBA provides guarantees for 50 percent to 85 percent of working capital loans for domestic projects, and up to 95 percent for projects involving exports.

A company must first obtain approval from a bank, then apply to the SBA for a guarantee.

When asked about loans to small business, several banks contacted by The Miami Herald said they were still approving small business credits and considered these companies an important element of their business portfolios.

However, some said standards are being tightened. Some also asserted they have increased loans to small business on a nationwide basis. All said they are reaching out to small business clients in an effort to work out financing problems.

"Small business loans are part of our core business and we continue to make these loans," said Nancy Norris, a spokeswoman for JP Morgan Chase and Washington Mutual.

"We have tightened our underwriting standards. We're making an effort to ensure that we provide loans to people who can afford them and that they represent a reasonable risk to the bank. We're working hard with our clients to find solutions."

Other banks contacted were Bank of America, SunTrust, Wachovia (now part of Wells Fargo), and Regions Bank.

Bill Bartmann, a small business expert, warned that if owners of small companies want to survive, they must make radical adjustments to their businesses.

"The economy has changed and business has changed," said Bartmann, chief executive of BillionaireU.com, an online business educational site.

Banks, which "got into an awful lot of trouble by lending money to people who were unqualified," have now gone to the other extreme, he said.

Bartmann, who started up a multi-billion-dollar financial services company with a $13,000 loan, said that even businesses that have already taken steps to reduce overhead must do more in order to become a better risk for banks and improve their chances for survival.

Tuesday, August 25, 2009

Bill Bartmann in the News with new book, “Bailout Riches!

How Everyday Investors can make a Fortune Buying Bad Loans for Pennies on the Dollar

How does America’s financial crisis become an investment opportunity? It begins with over $1 trillion dollars in defaulted loans, credit card debts and other bad loans being written off and sold to investors for pennies on the dollar. Bill Bartmann has a proven system for buying the debt without using your own money.

Bill Bartmann is the author of Bailout Riches, a book to provide investors with the right roadmap to spectacular profits. The book lays out a step by step plan on finding deals from the federal government, local financial institutions and loan brokers. The defaulted loan types include credit card debt, consumer loans, business loans, commercial loans and real estate loans and mortgages.

In Bailout Riches!, Bill Bartmann shows how to invest in the bailout and take your own cut of the trillion dollar pie. Bill Bartmann is an authority on bailouts; during the last big-time government bailout, Bill Bartmann built a debt collection company and became a billionaire. According to Bill Bartmann, today’s bailout is much bigger and opportunities for profit are much greater.

Bad-Debts: Bad for the Bank – Good for the Investor

Billions of taxpayer dollars are being used to buy bad debts from banks to keep them solvent as borrowers default on their loans. These debts are being sold for pennies on the dollar to anyone willing to buy them; however, they are not necessarily worthless investments.

For example, you by a $5,000 bad loan for $250.00. Next, you approach the borrower in default and offer them a chance to settle the debt for $500. If they agree, you just made a one hundred percent profit on your investment. This is a win-win-win situation; the bad loan is off the bank’s books, the borrower is out of debt and you made a profit.

Why would Bill Bartmann Share this Information?

Bill Bartmann made his fortune buying bad debts. In his book, he shows how you can make yours too. You may wonder why Bartmann would share something like this with the world. The reason is simple; there’s plenty to go around. In the next year or two around $1 trillion of debt will be written down and sold cheap.

Bailout Riches! lays out a step by step plan for finding the best deals on loan packages, building a valuable debt portfolio and collecting from debtors with less hassle. Bill Bartmann’s proven successful program is simple to follow; it’s practical and it’s cheap to get started. Bailout Riches! will show you how to jump on the biggest gravy train in recent history.

Bill Bartmann is the author of Bailout Riches! and the creator of America’s largest debt-buying and debt-collection company. Bill Bartmann has been listed among Forbes Magazine’s 400 wealthiest Americans and has twice been named National Entrepreneur of the Year by USA Today, NASDAQ, Inc Magazine, Ernst & Young and the Kauffman Foundation.

How does America’s financial crisis become an investment opportunity? It begins with over $1 trillion dollars in defaulted loans, credit card debts and other bad loans being written off and sold to investors for pennies on the dollar. Bill Bartmann has a proven system for buying the debt without using your own money.

Bill Bartmann is the author of Bailout Riches, a book to provide investors with the right roadmap to spectacular profits. The book lays out a step by step plan on finding deals from the federal government, local financial institutions and loan brokers. The defaulted loan types include credit card debt, consumer loans, business loans, commercial loans and real estate loans and mortgages.

In Bailout Riches!, Bill Bartmann shows how to invest in the bailout and take your own cut of the trillion dollar pie. Bill Bartmann is an authority on bailouts; during the last big-time government bailout, Bill Bartmann built a debt collection company and became a billionaire. According to Bill Bartmann, today’s bailout is much bigger and opportunities for profit are much greater.

Bad-Debts: Bad for the Bank – Good for the Investor

Billions of taxpayer dollars are being used to buy bad debts from banks to keep them solvent as borrowers default on their loans. These debts are being sold for pennies on the dollar to anyone willing to buy them; however, they are not necessarily worthless investments.

For example, you by a $5,000 bad loan for $250.00. Next, you approach the borrower in default and offer them a chance to settle the debt for $500. If they agree, you just made a one hundred percent profit on your investment. This is a win-win-win situation; the bad loan is off the bank’s books, the borrower is out of debt and you made a profit.

Why would Bill Bartmann Share this Information?

Bill Bartmann made his fortune buying bad debts. In his book, he shows how you can make yours too. You may wonder why Bartmann would share something like this with the world. The reason is simple; there’s plenty to go around. In the next year or two around $1 trillion of debt will be written down and sold cheap.

Bailout Riches! lays out a step by step plan for finding the best deals on loan packages, building a valuable debt portfolio and collecting from debtors with less hassle. Bill Bartmann’s proven successful program is simple to follow; it’s practical and it’s cheap to get started. Bailout Riches! will show you how to jump on the biggest gravy train in recent history.

Bill Bartmann is the author of Bailout Riches! and the creator of America’s largest debt-buying and debt-collection company. Bill Bartmann has been listed among Forbes Magazine’s 400 wealthiest Americans and has twice been named National Entrepreneur of the Year by USA Today, NASDAQ, Inc Magazine, Ernst & Young and the Kauffman Foundation.

Bill Bartmann is a “Rags to Riches” Authority

Bill Bartmann has had his share of ups and downs, personally and financially. He began in the down position, the youngest of eight children in a family where the parents worked low-wage jobs and they moved around a lot.

Bill Bartmann left home at the age of 14, travelled with a carnival and later joined a street gang. By the age of 17 he was an alcoholic. On night when he was intoxicated, he fell down some stairs and was seriously injured; he was told he would never walk again.

Bill Bartmann’s first Rags to Riches success began at this point in his life. Bill Bartmann really began to impress people when he walked out of the hospital, got his GED, went to college and then law school. He became wealthy investing in real estate and later went into the oil business.

Bill Bartmann was living the good life of a successful business man until OPEC slashed the price of oil, forcing Bill out of business and one million dollars in debt!

Rags to Riches Again!

Bill Bartmann refused to give up. Bill and his wife and business partner, Kathy, borrowed $13,000 to buy bad loans offered by the Federal Deposit Insurance Corporation. Within three years they paid their entire million dollar debt from the oil business as they grew there new debt collections company. The company grew over the next 13 years with 3,900 employees and revenues in excess of $1 billion.

Company Success passed on to Employees

Bill Bartmann and his wife ran a very successful company while taking great care of their employees. They pioneered novel financial instruments still used today on Wall Street. They implemented fantastic benefits for employees including salaries at twice the industry standard, free health care, free on-site child care, 250% 401K match program and company trips for all employees and spouses.

The annual trips included places like the Bahamas, Las Vegas and ocean cruises. One year they leased 27 Boeing 747s to fly 6,000 employees and spouses to Disney World from Tulsa.

Bill and Kathy Bartmann have been recognized on the covers of national business magazines; Kathy on the cover of Forbes and Bill on the cover of Inc. They were listed individually in the Forbes 400 wealthiest people in America; one national magazine ranked them number 25.

A Heart-breaking Setback

Bill Bartmann suffered another setback when his former business partner committed fraud; the company was forced into bankruptcy. His partner later admitted to having committed the fraud without Bill’s knowledge and was sent to prison.

During the ordeal Bill Bartmann was indicted on 57 felony counts; if convicted he faced 600 years in prison! There was a 2-1/2 month long trial where the government produced 1,000 exhibits and called 53 witnesses to prove Bartmann guilty. Bill Bartmann rested his case without calling a single witness or producing a single exhibit. He wasn’t guilty; the jury unanimously acquitted Bill Bartmann on all counts.

The Federal Bankruptcy Trustee issued a report 17 months after Bartmann’s acquittal, publicly acknowledging “Bills company had not committed fraud.”

From Rags to Bailout Riches

Bill Bartmann does not give up hope! Though this experience would have embittered most people, Bill Bartmann forgives those who did him wrong and focuses on moving ahead. Bill Bartmann believes that failures are life’s greatest lessons and he certainly has learned his share of valuable lessons in his life.

Bill Bartmann travels the country, sharing his story of his successes and how he dealt with challenges. He has written a new book, Bailout Riches, to share insights on how regular citizens can benefit from the most recent economic crisis. Bill Bartmann says there is no need to become a victim of the economy; another statistic for the nightly news.

Bill Bartmann’s book will show how he made a billion dollars in the last economic crisis and how the opportunity is even bigger this time around. Read Bailout Riches, follow Bill’s tested and proven steps and make a fortune buying bad loans for pennies on the dollar.

Bill Bartmann left home at the age of 14, travelled with a carnival and later joined a street gang. By the age of 17 he was an alcoholic. On night when he was intoxicated, he fell down some stairs and was seriously injured; he was told he would never walk again.

Bill Bartmann’s first Rags to Riches success began at this point in his life. Bill Bartmann really began to impress people when he walked out of the hospital, got his GED, went to college and then law school. He became wealthy investing in real estate and later went into the oil business.

Bill Bartmann was living the good life of a successful business man until OPEC slashed the price of oil, forcing Bill out of business and one million dollars in debt!

Rags to Riches Again!

Bill Bartmann refused to give up. Bill and his wife and business partner, Kathy, borrowed $13,000 to buy bad loans offered by the Federal Deposit Insurance Corporation. Within three years they paid their entire million dollar debt from the oil business as they grew there new debt collections company. The company grew over the next 13 years with 3,900 employees and revenues in excess of $1 billion.

Company Success passed on to Employees

Bill Bartmann and his wife ran a very successful company while taking great care of their employees. They pioneered novel financial instruments still used today on Wall Street. They implemented fantastic benefits for employees including salaries at twice the industry standard, free health care, free on-site child care, 250% 401K match program and company trips for all employees and spouses.

The annual trips included places like the Bahamas, Las Vegas and ocean cruises. One year they leased 27 Boeing 747s to fly 6,000 employees and spouses to Disney World from Tulsa.

Bill and Kathy Bartmann have been recognized on the covers of national business magazines; Kathy on the cover of Forbes and Bill on the cover of Inc. They were listed individually in the Forbes 400 wealthiest people in America; one national magazine ranked them number 25.

A Heart-breaking Setback

Bill Bartmann suffered another setback when his former business partner committed fraud; the company was forced into bankruptcy. His partner later admitted to having committed the fraud without Bill’s knowledge and was sent to prison.

During the ordeal Bill Bartmann was indicted on 57 felony counts; if convicted he faced 600 years in prison! There was a 2-1/2 month long trial where the government produced 1,000 exhibits and called 53 witnesses to prove Bartmann guilty. Bill Bartmann rested his case without calling a single witness or producing a single exhibit. He wasn’t guilty; the jury unanimously acquitted Bill Bartmann on all counts.

The Federal Bankruptcy Trustee issued a report 17 months after Bartmann’s acquittal, publicly acknowledging “Bills company had not committed fraud.”

From Rags to Bailout Riches

Bill Bartmann does not give up hope! Though this experience would have embittered most people, Bill Bartmann forgives those who did him wrong and focuses on moving ahead. Bill Bartmann believes that failures are life’s greatest lessons and he certainly has learned his share of valuable lessons in his life.

Bill Bartmann travels the country, sharing his story of his successes and how he dealt with challenges. He has written a new book, Bailout Riches, to share insights on how regular citizens can benefit from the most recent economic crisis. Bill Bartmann says there is no need to become a victim of the economy; another statistic for the nightly news.

Bill Bartmann’s book will show how he made a billion dollars in the last economic crisis and how the opportunity is even bigger this time around. Read Bailout Riches, follow Bill’s tested and proven steps and make a fortune buying bad loans for pennies on the dollar.

Bill Bartmann, a Free Man, once Faced a 600 Year Prison Sentence!

Bill Bartmann was indicted on 57 federal felony counts in 2002; Attorney General, John Ashcroft alleged that he was guilty of making fake transactions to shell companies in order to falsify his balance sheet.

Bill Bartmann said, “Ashcroft’s action was after two grand juries voted not to indict. I didn’t know if it was a slow new week at the Justice Department or whether he hoped to find the next Enron-type scandal. All I knew was that I faced a cumulative 600 years in prison if convicted.

Bill Bartmann went into survival mode as he faced the situation head-on. He chose to be honest with his family and not try to sugar coat anything. “The natural inclination is to attempt to shield the ones you love,” said Bartmann, “but your desire to protect will produce the opposite result. Silence allows them to conjure up the most dreaded of possibilities.”

It was a very painful experience for Bill Bartmann, his wife and two young daughters as they witnessed all 89 days of his trial. His wife and daughters watched as the government produced more than 1,000 exhibits and called 53 witnesses in their effort to show Bartmann as a crook. “I produced zero exhibits and called no witnesses, because I had not broken the law,” said Bartmann. “My family also got to hear first-hand when the jury found me not guilty on all 57 counts.” A public statement was later made to confirm that Bill Bartmann had not committed any fraud.

Bill Bartmann was not guilty; however, he was devastated. The lifeblood of his company consisted of credit lines; those lines vanished at the hint of fraudulent activity. Bill Bartmann was a billionaire and the 25th richest person in America one day; bankrupt the next.

Bill Bartmann took steps to accept responsibility for his own actions. “People like winners, not whiners,” said Bartmann. Though he was not guilty of any crime, Bartmann was the head of a company employing 3,900 people, all of whom lost their jobs. “Accepting responsibility for a failure didn’t make me a bad human being – it instead made me a real human being.”

Bill Bartmann is not one to give up, no matter how bad things get. He didn’t wallow in bitterness and self-pity when the bankruptcy judge had a crew come to his home on Christmas week to chainsaw a hunk off his pool house; it was just a few feet over the one acre of land she would allow him to keep in bankruptcy.

Bill Bartmann would not have been able to move on and bounce back to success if he continued to relive the bad times. This is why he closed this chapter in his life and began writing the next one. Bill Bartmann concentrated his energy on building a thriving business of teaching entrepreneurs how to remove obstacles that stand in their way to success. His new book, Bailout Riches, has reached Amazon #1 world-wide best-seller status. The book shows ordinary people how to capitalize on the current government bailouts.

Bill Bartmann believes it is better to forgive others for their wrong doing rather than focusing on revenge which only produces negative energy. He learned that Attorney General, John Ashcroft would be at a book signing in Chicago while he was in town. Bill got in line, wearing a name tag that simply said, “Hi, My Name is Bill.” When he got to the head of the line, Ashcroft greeted him, saying “Hi Bill, where are you from?”

Bill said, “I’m from Tulsa.”

“Oh, really? We had a big case there a couple years ago.”

“Yes, I know. It was mine.” The color drained from his face as Ashcroft recognized Bill Bartmann.

“Mr. Ashcroft, you know now – and you knew then – that I was innocent. Your actions cost 3,900 people their jobs, and cost me $3.5 billion, not to mention enormous anguish on the part of my family. Mr. Ashcroft, I came here for one reason – to forgive you.”

Bill Bartmann turned and left before Ashcroft had a chance to react. He wasn’t concerned with his reaction; he did it for his own peace of mind and mental well-being.

Bill Bartmann says that when your world comes crashing down around you, your attitude toward failure will determine if you recover and become successful again. “Nature is all about regeneration,” said Bartmann. “You’re the most developed product of evolution up until this moment; you have the capacity for renewal.”

Bill Bartmann said, “Ashcroft’s action was after two grand juries voted not to indict. I didn’t know if it was a slow new week at the Justice Department or whether he hoped to find the next Enron-type scandal. All I knew was that I faced a cumulative 600 years in prison if convicted.

Bill Bartmann went into survival mode as he faced the situation head-on. He chose to be honest with his family and not try to sugar coat anything. “The natural inclination is to attempt to shield the ones you love,” said Bartmann, “but your desire to protect will produce the opposite result. Silence allows them to conjure up the most dreaded of possibilities.”

It was a very painful experience for Bill Bartmann, his wife and two young daughters as they witnessed all 89 days of his trial. His wife and daughters watched as the government produced more than 1,000 exhibits and called 53 witnesses in their effort to show Bartmann as a crook. “I produced zero exhibits and called no witnesses, because I had not broken the law,” said Bartmann. “My family also got to hear first-hand when the jury found me not guilty on all 57 counts.” A public statement was later made to confirm that Bill Bartmann had not committed any fraud.

Bill Bartmann was not guilty; however, he was devastated. The lifeblood of his company consisted of credit lines; those lines vanished at the hint of fraudulent activity. Bill Bartmann was a billionaire and the 25th richest person in America one day; bankrupt the next.

Bill Bartmann took steps to accept responsibility for his own actions. “People like winners, not whiners,” said Bartmann. Though he was not guilty of any crime, Bartmann was the head of a company employing 3,900 people, all of whom lost their jobs. “Accepting responsibility for a failure didn’t make me a bad human being – it instead made me a real human being.”

Bill Bartmann is not one to give up, no matter how bad things get. He didn’t wallow in bitterness and self-pity when the bankruptcy judge had a crew come to his home on Christmas week to chainsaw a hunk off his pool house; it was just a few feet over the one acre of land she would allow him to keep in bankruptcy.

Bill Bartmann would not have been able to move on and bounce back to success if he continued to relive the bad times. This is why he closed this chapter in his life and began writing the next one. Bill Bartmann concentrated his energy on building a thriving business of teaching entrepreneurs how to remove obstacles that stand in their way to success. His new book, Bailout Riches, has reached Amazon #1 world-wide best-seller status. The book shows ordinary people how to capitalize on the current government bailouts.

Bill Bartmann believes it is better to forgive others for their wrong doing rather than focusing on revenge which only produces negative energy. He learned that Attorney General, John Ashcroft would be at a book signing in Chicago while he was in town. Bill got in line, wearing a name tag that simply said, “Hi, My Name is Bill.” When he got to the head of the line, Ashcroft greeted him, saying “Hi Bill, where are you from?”

Bill said, “I’m from Tulsa.”

“Oh, really? We had a big case there a couple years ago.”

“Yes, I know. It was mine.” The color drained from his face as Ashcroft recognized Bill Bartmann.

“Mr. Ashcroft, you know now – and you knew then – that I was innocent. Your actions cost 3,900 people their jobs, and cost me $3.5 billion, not to mention enormous anguish on the part of my family. Mr. Ashcroft, I came here for one reason – to forgive you.”

Bill Bartmann turned and left before Ashcroft had a chance to react. He wasn’t concerned with his reaction; he did it for his own peace of mind and mental well-being.

Bill Bartmann says that when your world comes crashing down around you, your attitude toward failure will determine if you recover and become successful again. “Nature is all about regeneration,” said Bartmann. “You’re the most developed product of evolution up until this moment; you have the capacity for renewal.”

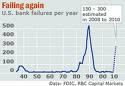

Bill Bartmann in the News: Bill Bartmann Discusses Bank Failures

The government announces the collapse of another bank nearly every week; sometimes 3 or 4. According to Bill Bartmann, we are amid the worst banking crisis since the Savings & Loan crisis nearly twenty years ago.

Over 75 banks have failed already this year, nearly three times the total last year. Thanks to the Federal Deposit Insurance Corporation, depositors are rarely affected.

Bill Bartmann believes more than 1,000 more banks will fail over the next eighteen months. These failures will cost the FDIC nearly $70 billion through the year 2013 with most of that amount coming by next year.

How does a bank fail?

Though bank closures are usually announced on Friday after the close of business, it is a very lengthy process. Simply put, the government closes a bank when it cannot meet its obligations to depositors and others. Bank failures have increased dramatically as the economic downturn has forced mortgage holders and business owners to default on loans.

The process begins with troubled lenders being placed on the FDIC watch list. At this point, the bank is losing capital at a disturbing rate. There are currently over 300 bans on the watch list; a huge increase from only 50 at the end of 2006.

Bill Bartmann knew about the recent Colonial Bank failure nearly three months before it was announced. “We were offered an opportunity to look at the assets and kick the tires on this used car. We passed on it because it didn’t fit our appetite,” said Bartmann. During the S&L crisis in the late 1980s, Bill Bartmann bought assets from more than 800 failed banks.

When a bank fails, the FDIC attempts to find a suitor for the assets. Often, the agency will hold them and try to unload them later through contractors such as DebtX and First Financial Network or through other structured vehicles.

The FDIC does not actually close the bank; once they are done shopping the bank’s assets, the institution can be closed by the Office of Thrift Supervision, the Office of the Comptroller of the Currency or a state regulator.

Once a bank closes, typically on a Friday after business hours, the FDIC works with the institution to ensure the doors open Monday for depositors to access their money. This is a very busy weekend for the FDIC; they have to get familiar with the operations, work with employees to ensure pay and health benefits, pair up the human resources and IT teams and transfer the account records. “The customer in most cases sees it as a seamless transition, said Bill Bartmann. The next day the customer can go to the bank and his deposits are safe and exactly where they were the day before.”

More Failures to come

Since the FDIC was formed 75 years ago, no depositor has lost money on insured deposits. The agency recently increased their insurance to cover amounts up to $250,000. “That’s a remarkable history given the chaos our country has been through,” said Bartmann.

Bill Bartmann credits the FDIC Chairman Sheila Bair with the agency’s performance during the current crisis. “I’ve been married for 36 years. If I wasn’t married to my present wife, I would chase this woman down,” said Bill Bartmann. “She has more courage than any chair of the FDIC to date.”

The FDIC employs 7,000 people in more than 80 field offices; they will likely stay busy in the months ahead as the next wave of bank failures is expected to hit community banks. Bill Bartmann expects to see many more banks fail as commercial real estate loans default and local shops we drive by every day go under.

Bill Bartmann is the author of Bailout Riches: How Everyday Investors Can Make a Fortune Buying Bad Loans for Pennies on the Dollar. The book recently became an Amazon #1 world-wide best-seller. Bill Bartmann has been in every major newspaper and is frequently interviewed on television and radio.

Over 75 banks have failed already this year, nearly three times the total last year. Thanks to the Federal Deposit Insurance Corporation, depositors are rarely affected.

Bill Bartmann believes more than 1,000 more banks will fail over the next eighteen months. These failures will cost the FDIC nearly $70 billion through the year 2013 with most of that amount coming by next year.

How does a bank fail?

Though bank closures are usually announced on Friday after the close of business, it is a very lengthy process. Simply put, the government closes a bank when it cannot meet its obligations to depositors and others. Bank failures have increased dramatically as the economic downturn has forced mortgage holders and business owners to default on loans.

The process begins with troubled lenders being placed on the FDIC watch list. At this point, the bank is losing capital at a disturbing rate. There are currently over 300 bans on the watch list; a huge increase from only 50 at the end of 2006.

Bill Bartmann knew about the recent Colonial Bank failure nearly three months before it was announced. “We were offered an opportunity to look at the assets and kick the tires on this used car. We passed on it because it didn’t fit our appetite,” said Bartmann. During the S&L crisis in the late 1980s, Bill Bartmann bought assets from more than 800 failed banks.

When a bank fails, the FDIC attempts to find a suitor for the assets. Often, the agency will hold them and try to unload them later through contractors such as DebtX and First Financial Network or through other structured vehicles.

The FDIC does not actually close the bank; once they are done shopping the bank’s assets, the institution can be closed by the Office of Thrift Supervision, the Office of the Comptroller of the Currency or a state regulator.

Once a bank closes, typically on a Friday after business hours, the FDIC works with the institution to ensure the doors open Monday for depositors to access their money. This is a very busy weekend for the FDIC; they have to get familiar with the operations, work with employees to ensure pay and health benefits, pair up the human resources and IT teams and transfer the account records. “The customer in most cases sees it as a seamless transition, said Bill Bartmann. The next day the customer can go to the bank and his deposits are safe and exactly where they were the day before.”

More Failures to come

Since the FDIC was formed 75 years ago, no depositor has lost money on insured deposits. The agency recently increased their insurance to cover amounts up to $250,000. “That’s a remarkable history given the chaos our country has been through,” said Bartmann.

Bill Bartmann credits the FDIC Chairman Sheila Bair with the agency’s performance during the current crisis. “I’ve been married for 36 years. If I wasn’t married to my present wife, I would chase this woman down,” said Bill Bartmann. “She has more courage than any chair of the FDIC to date.”

The FDIC employs 7,000 people in more than 80 field offices; they will likely stay busy in the months ahead as the next wave of bank failures is expected to hit community banks. Bill Bartmann expects to see many more banks fail as commercial real estate loans default and local shops we drive by every day go under.

Bill Bartmann is the author of Bailout Riches: How Everyday Investors Can Make a Fortune Buying Bad Loans for Pennies on the Dollar. The book recently became an Amazon #1 world-wide best-seller. Bill Bartmann has been in every major newspaper and is frequently interviewed on television and radio.

Subscribe to:

Comments (Atom)