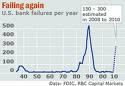

The changing economy is influencing the way lenders measure their risk when extending credit

Bill Batmann is a small business expert and the CEO of BillionaireU.com, an online business educational site. During a recent interview, Bill Bartmann warned small business owners that they would have to make radical adjustments to their business in order to survive.

“The economy has changed and business has changed,” said Bartmann. Banks, which got into an awful lot of trouble by lending money to people who are unqualified, have now gone to the other extreme. Even those businesses who have already taken steps to reduce overhead must do more in order to become a better risk for banks and to improve their chances for survival.”

Bill Bartmann teaches his students to realize that small business loans are a major part of some lenders’ business. “Banks want to loan money; this is how they make money,” Bartmann explains. “With the changing economy, lenders are forced to tighten their standards and minimize their risk. This means business owners need to make changes in order to demonstrate their ability to repay a business loan.”

Bill Bartmann has been interviewed on television and radio shows and featured in magazines. He has been credited with singlehandedly changing and reforming the collection industry in America. His mission, just as ambitious, is to "reverse the business failure rate in America".

Saturday, November 28, 2009

Sunday, November 8, 2009

Bill Bartmann Discusses Tough Times for Small Business Owners who need Capital

Bill Bartmann has been interviewed on radio and TV and he has been published in many magazines. Here is a story by Joseph A. Mann Jr, that was printed in the Miami Harold.

Lack of Credit Hurts Small Businesses:

For the last quarter of 2008, banks approved 181 working capital loans worth $53.7 million dollars. In the same quarter of 2007, there were 908 loan approvals for a total of $136.5 million.

"The trick is, we can't do anything if the bank doesn't give a loan," said Althea Harris, the SBA's public affairs officer in Miami. Under one of its programs, the SBA provides guarantees for 50 percent to 85 percent of working capital loans for domestic projects, and up to 95 percent for projects involving exports.

A company must first obtain approval from a bank, then apply to the SBA for a guarantee.

When asked about loans to small business, several banks contacted by The Miami Herald said they were still approving small business credits and considered these companies an important element of their business portfolios.

However, some said standards are being tightened. Some also asserted they have increased loans to small business on a nationwide basis. All said they are reaching out to small business clients in an effort to work out financing problems.

"Small business loans are part of our core business and we continue to make these loans," said Nancy Norris, a spokeswoman for JP Morgan Chase and Washington Mutual.

"We have tightened our underwriting standards. We're making an effort to ensure that we provide loans to people who can afford them and that they represent a reasonable risk to the bank. We're working hard with our clients to find solutions."

Other banks contacted were Bank of America, SunTrust, Wachovia (now part of Wells Fargo), and Regions Bank.

Bill Bartmann, a small business expert, warned that if owners of small companies want to survive, they must make radical adjustments to their businesses.

"The economy has changed and business has changed," said Bartmann, chief executive of BillionaireU.com, an online business educational site.

Banks, which "got into an awful lot of trouble by lending money to people who were unqualified," have now gone to the other extreme, he said.

Bartmann, who started up a multi-billion-dollar financial services company with a $13,000 loan, said that even businesses that have already taken steps to reduce overhead must do more in order to become a better risk for banks and improve their chances for survival.

Lack of Credit Hurts Small Businesses:

For the last quarter of 2008, banks approved 181 working capital loans worth $53.7 million dollars. In the same quarter of 2007, there were 908 loan approvals for a total of $136.5 million.

"The trick is, we can't do anything if the bank doesn't give a loan," said Althea Harris, the SBA's public affairs officer in Miami. Under one of its programs, the SBA provides guarantees for 50 percent to 85 percent of working capital loans for domestic projects, and up to 95 percent for projects involving exports.

A company must first obtain approval from a bank, then apply to the SBA for a guarantee.

When asked about loans to small business, several banks contacted by The Miami Herald said they were still approving small business credits and considered these companies an important element of their business portfolios.

However, some said standards are being tightened. Some also asserted they have increased loans to small business on a nationwide basis. All said they are reaching out to small business clients in an effort to work out financing problems.

"Small business loans are part of our core business and we continue to make these loans," said Nancy Norris, a spokeswoman for JP Morgan Chase and Washington Mutual.

"We have tightened our underwriting standards. We're making an effort to ensure that we provide loans to people who can afford them and that they represent a reasonable risk to the bank. We're working hard with our clients to find solutions."

Other banks contacted were Bank of America, SunTrust, Wachovia (now part of Wells Fargo), and Regions Bank.

Bill Bartmann, a small business expert, warned that if owners of small companies want to survive, they must make radical adjustments to their businesses.

"The economy has changed and business has changed," said Bartmann, chief executive of BillionaireU.com, an online business educational site.

Banks, which "got into an awful lot of trouble by lending money to people who were unqualified," have now gone to the other extreme, he said.

Bartmann, who started up a multi-billion-dollar financial services company with a $13,000 loan, said that even businesses that have already taken steps to reduce overhead must do more in order to become a better risk for banks and improve their chances for survival.

Subscribe to:

Posts (Atom)